Our differentiation - Zero commission, zero management fees, capital preservation

What you can expect

your investment

Investment commitment $$$ and returns $$$

You must commit at least $25,000 or more for at least 1 year. You MUST be an accredited investor to invest with us, unless you are 1 of the first 35 investors. Depending your investment amount and the time commitment, your yearly return could be >40%. All investments are guaranteed capital preservation up to 75% of your investment amount. Another word – at most most you could lose with us is 25% (worst case scenario when the world has fallen apart), and we bear the responsibility to return at least 75% of your capital if we lose money.

To be an accredited investor, you must have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years, with the expectation of earning the same or a higher income in the current year. You must have earned income above the thresholds either alone or with your spouse over the last two years.

You can also considered as an accredited investor if you have a net worth exceeding $1 million, either individually or jointly with your spouse. The SEC also considers a person to be an accredited investor if they are a general partner, executive officer, or director for the company that is issuing the unregistered securities.

An entity is considered an accredited investor if it is a private business development company or an organization with assets exceeding $5 million. Also, if an entity consists of equity owners who are accredited investors, the entity itself is an accredited investor. However, an organization cannot be formed with the sole purpose of purchasing specific securities. If a person can demonstrate sufficient education or job experience showing their professional knowledge of unregistered securities, they too can qualify to be considered an accredited investor.

In 2020, the U.S. Congress modified the definition of an accredited investor to include registered brokers and investment advisors.

To learn more about accredited investors, please visit https://www.investopedia.com/terms/a/accreditedinvestor.asp.

To learn more about Rule 506(b) of Regulation D, please visit https://www.sec.gov/smallbusiness/exemptofferings/rule506b.

Investment Lockup period

Your investment will be locked for at least 1 year or more with us, no exceptions allowed. Your investment agreement will spell out the details. This is the nature of stock market investing. Once we have committed your money into our investment pool, we are not able to take out your portion from the pool until we reach our preset date. All of our investors money goes into an investment pool and we calculate investment return based on the pool’s return and allocate your return proportionately to your contribution to the pool.

our simulation trade data

Our "try" before we "buy" R&D Approach

We have developed the M3 algorithm after 14 years of research. When we finally became convinced that our algorithm works, we have decided to test run the algo against the real market with real-time simulation. After running the algorithm against the real market data under real market conditions since October 2021 until September 2022, we were able to make >50% return on our investment. The image on the right shows how our account behaved during the simulation period.

Putting the algorithm to real test

After being convinced that our algo works, we ran the algorithm using an actual trading account to check if simulation trades could be replicated for the actual trading account. Our result – an ABSOLUTE Yes!

Your expected Returns

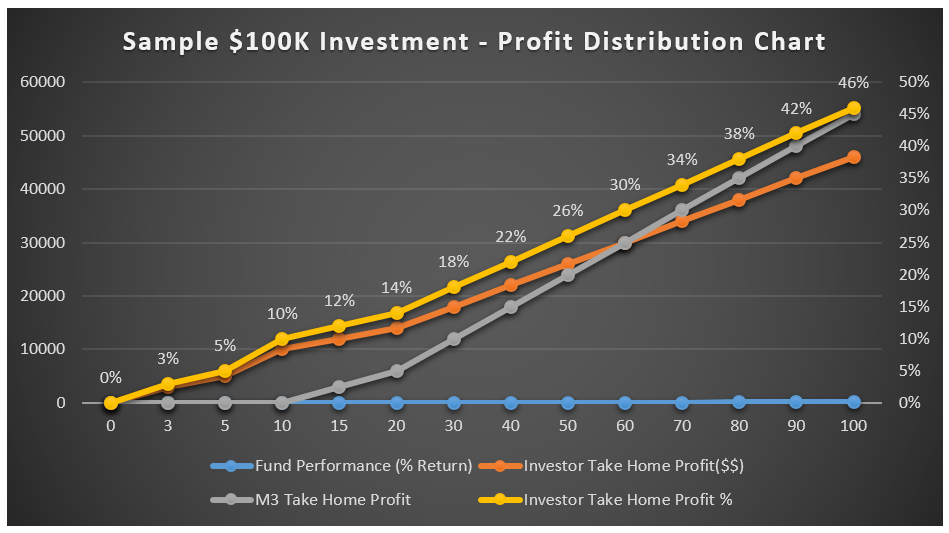

The following table shows how our fee structure works and how it is favorable to the investor. M3 is incentivize to perform better and investor takes more of the profit until M3 performance is over 60%. After M3 has crossed >60% return, only then M3’s cut of the profit gets better.

Sample Fee Structure

Investment Amount | M3 Performance (% Profit) | Investor takes home: | M3 takes: |

$100K | 3% | $3K (+$100K = $103K) | $0 |

$100K | 5% | $5K (+$100K = $105K) | $0 |

$100K | 10% | $10K (+$100K = $110K) | $0 |

$100K | 15% | $10K+ $2K = $12K (+$100K = $112K) | $3K |

$100K | 30% | $10K+ $8K = $18K (+$100K = $118K) | $12K |

$100K | 40% | $10K + $12K = $22K (+$100K = $122K) | $18K |

$100K | 50% | $10K + $16K = $26K (+$100K = $126K) | $24K |

$100K | 60% | $10K + $20K = $30K (+$100K = $130K) | $30K |

$100K | 70% | $10K + $24K = $34K (+$100K = $134K) | $36K |

$100K | 80% | $10K + $28K = $38K (+$100K = $138K) | $42K |

$100K | 90% | $10K + $32K = $42K (+$100K = $142K) | $48K |

$100K | 100% | $10K + $36K = $46K (+$100K = $146K) | $54K |

*Note: This is a sample for illustration purposes only, not a representation of actual performance nor an actual offer. Your target return may be different based on your investment amount and the duration of your lockup period. | |||

How we got here

With lots of pain along the way

We have made all the mistakes described in the section below (Reasons for Stock Market Losses) and learned our lessons the hard way. We are battle tested and wise learning from our own as well as others mistakes.

M3 Novelty - We can expand exponentially

many fund managers are successful with little money, but not with lots of money, why so?

There are many successful fund managers who have demonstrated stellar performance with portfolios of several million dollars – but when given one billion dollars to work with, they can’t find good enough investments to use the money effectively. It is not easy to find good investments every day when trading manually, and that is the reason why these fund managers have not been able to take advantage of the full potential of their big money.

Those who have succeeded under these circumstances, such as Renaissance Technologies (founded by Jim Simons) or Bridgewater Capital (founded by Ray Dalio), use some degree of computational or algorithmic trading. They use proprietary trading systems and algorithms built using their knowledge of financial markets and technology. We intend to improve upon these ideas – our algorithm will scale up proportionately, no matter how much money is fed into it!

Reasons for stock market losses

1. Trading based on emotion

More than 90% of active traders lose money in the stock market, primarily due to emotional trades. A trader might develop an attachment to a certain stock, or hatred towards another. These traders make trading decisions based on their emotional states.

The M3 algorithm is emotionless – it never falls in love or learns to hate any individual security. It will trade in any stock where it makes money, and exit positions at a preset profit target or loss.

2. Taking too-large positions

When a trader gets attached to a certain security, their emotions may drive them to take a larger position than they would otherwise. When the trader is wrong, instead of getting out at a small loss, they end up putting in more and more money – until the loss is too big to recover.

M3 takes measured incremental positions until certain thresholds are met. At this point, either profit is made, or it exits the position.

3. Lack of diversification

Most traders make portfolio decisions by manually researching stocks or following news headlines. However, many financial news outlets are funded by institutional investors who are getting ready to dump their positions. This leads to newbie traders buying positions at the higher end of the price move right as those investors are selling. Ultimately, the trader ends up holding only a few large positions, with no diversification in his or her portfolio.

As a computer-driven trading platform, M3 can easily keep track of thousands of trades all at once. This capability allows M3 to effectively diversify its entire portfolio, including hedged positions.

4. Lack of risk mitigation

While many pundits claim to be able to predict what will happen in the future, no one has ever been 100% correct in their predictions. In the stock market, past performance is no indication of future performance – what made money last year might be a total disaster next year. The best way to deal with such an uncertain future? Develop a strategy that works under any market condition.

Many traders become bullish in a bull market and end up taking too many long positions. In a bear market, they might do the complete opposite. However, the stock market history of the past 200 years tells us a very revealing story – the market will go up, and the market will go down, and that’s the pattern one needs to be prepared for. M3 takes that fact into the core of the algorithm, and manages trades by way of diversification and hedging at the same time.

5. Penny Stock/Speculative Trading

Penny stocks (stocks that trade under $5) or sub-penny stocks (stocks that trade below $1, or even $0.01) can make traders rich very quickly… if the trader is on the right side of the trade. Once in a while, these stocks can multiple by hundreds or even thousands in a very short amount of time, creating an illusion of a “get rich quick” opportunity. However, the reverse can also happen very quickly, with many of these stocks ending up in Chapter 11 or Chapter 7 bankruptcies while innocent people lose their hard-earned money.

M3 has built-in protection against penny stock trading and will never invest in such a scam